sales tax calculator buffalo ny

The New York sales tax rate is currently. Average Sales Tax With Local.

New York Car Sales Tax Calculator Ny Car Sales Tax Facts

14201 14202 14203.

. New York on the other hand only raises about 20 percent of its revenues from the. Sales and Use Tax Penalties TB-ST-805 Penalty and Interest Calculator. You could be subject to sales and use tax penalties if you fail to.

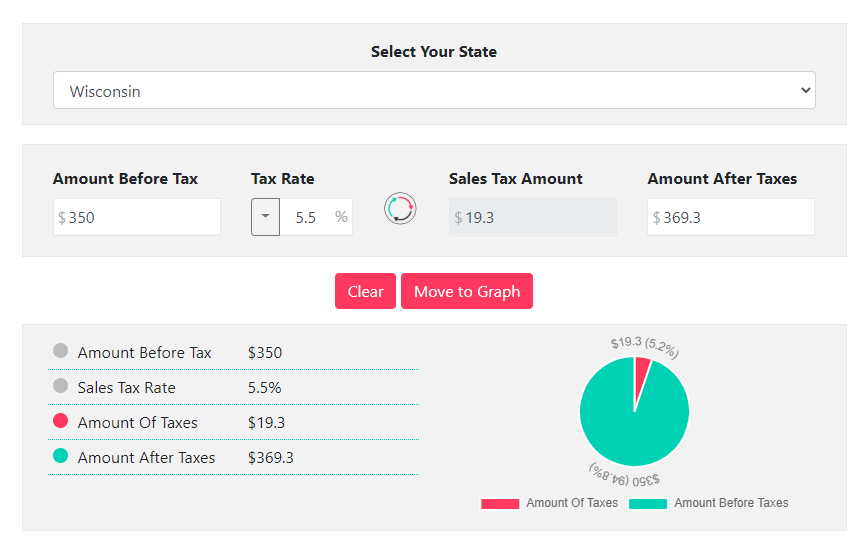

Sales Tax Calculator. Keep abreast of all changes in the New York State Real Property Tax Law RPTL affecting the City of Buffalo. Before-tax price sale tax rate and final or after-tax price.

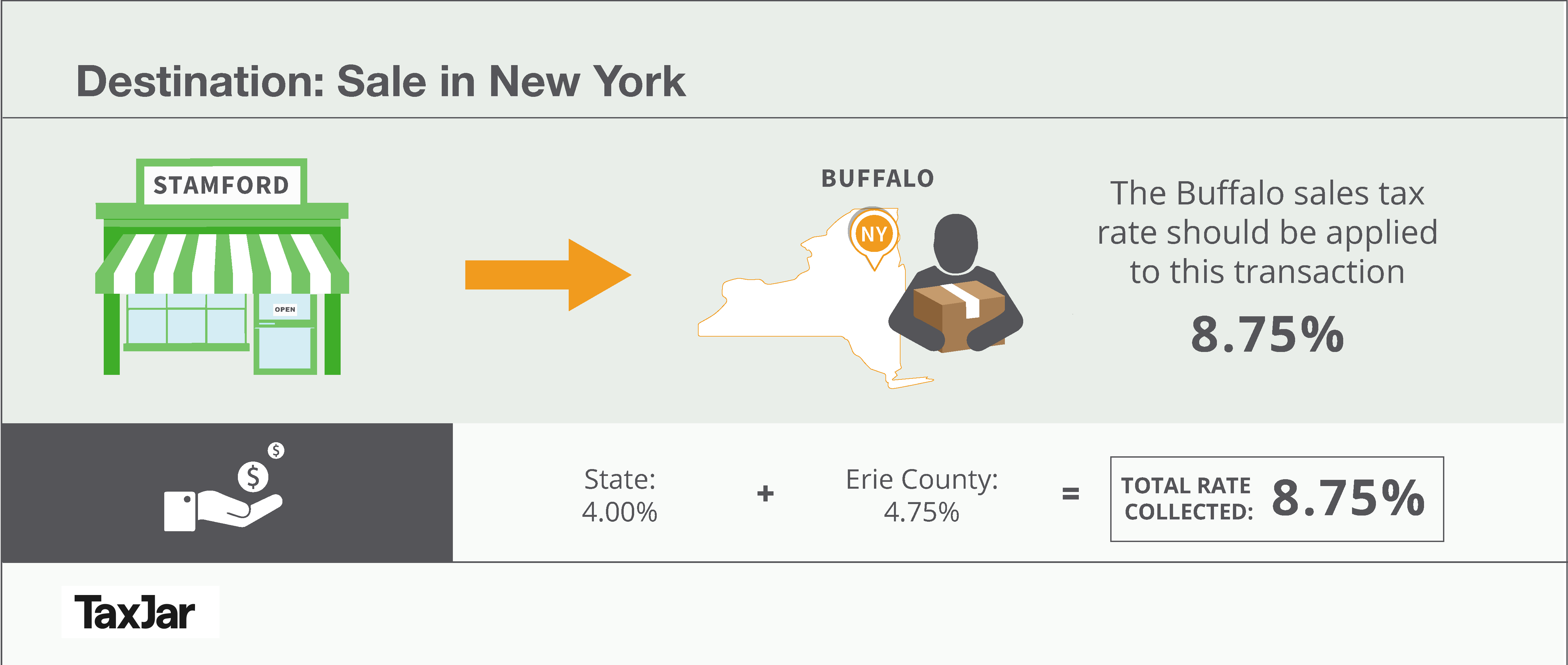

Sales taxes for a city or county in New York can be as high as 475 meaning you could potentially pay a total of 875 sales tax for a vehicle in. Register to collect tax. New York has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4875.

Sales Tax Breakdown Buffalo Details Buffalo NY is in Erie County. At 4 New Yorks sales tax rate is one of the highest in the country. This is the total of state county and city sales tax rates.

The December 2020 total local sales tax rate was also 8750. Collect and remit the proper amount of tax due. New York has a 4 statewide sales tax rate but also has 640 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4254 on top of the state tax.

Sales Tax State Local Sales Tax on Food. Use this calculator the find the amount paid on sales tax on an item and the total amount of the purchase. And several of these states raise nearly 60 percent of their tax revenue from the sales tax.

The sales tax added to the original purchase price produces the total cost of the purchase. Buffalo is in the following zip codes. For more information see.

An additional sales tax rate of 0375 applies to taxable sales made within the Metropolitan Commuter Transportation District MCTD. See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Buffalo NY. The minimum combined 2022 sales tax rate for Buffalo New York is.

The Buffalo sales tax rate is. Ad Lookup Sales Tax Rates For Free. The Sales Tax Calculator can compute any one of the following given inputs for the remaining two.

File sales and use tax returns on time. Interactive Tax Map Unlimited Use. The table below shows the total state and local sales tax rates for all New York counties.

400 New York State Sales Tax 088 Maximum Local Sales Tax 488 Maximum Possible Sales Tax 848 Average Local State Sales Tax. Enter zip codeof the sale location or the sales tax ratein percent Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax New York QuickFacts. There are a total of 988 local tax jurisdictions across the state collecting an average local tax of 4229.

See reviews photos directions phone numbers and more for Sales Tax Calculator locations in Buffalo NY. However all counties collect additional surcharges on top of that 4 rate. This means that depending on your location within New York the total tax you pay can be significantly higher than the 4 state sales tax.

If you frequently need the sales tax. Real property tax on median home. The combined sales and use tax rate equals the state rate currently 4 plus any local tax rate imposed by a city county or school district.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. This means that depending on where you are actual rates may be significantly higher than other parts of the country. Real property tax on median home.

Preparation of all delinquent tax. Buffalo NY Sales Tax Rate The current total local sales tax rate in Buffalo NY is 8750. Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due.

The County sales tax rate is. Sales Tax State Local Sales Tax on Food. Preparation and distribution of all property tax and sewer rent bills as well as local assessment bills including sidewalks demolitions etc and the maintenance of all associated records.

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car.

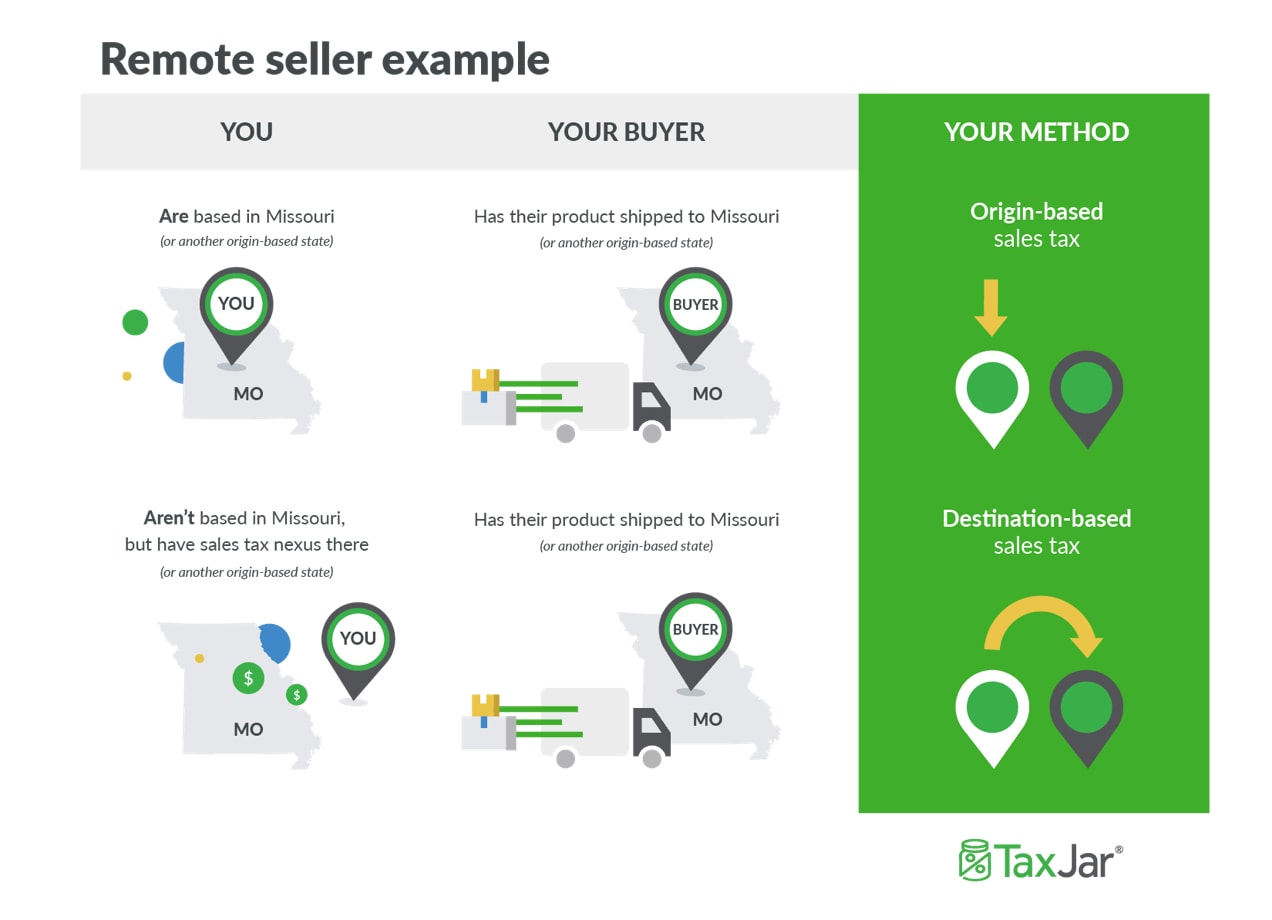

The Seller S Guide To Ecommerce Sales Tax Taxjar Developers

How To Charge Your Customers The Correct Sales Tax Rates

South Dakota Taxes Sd State Income Tax Calculator Community Tax

How To Charge Your Customers The Correct Sales Tax Rates

New York Property Tax Calculator 2020 Empire Center For Public Policy

Online Sales Tax Compliance Ecommerce Guide For 2022

New York Vehicle Sales Tax Fees Calculator

How To Charge Your Customers The Correct Sales Tax Rates

Fact Or Fiction Millennials Are The Rent Generation Home Made Blog Millennials Baby Boomers Generation Make Blog

New York Sales Tax Guide And Calculator 2022 Taxjar

How To Calculate New York Sales Tax 14 Steps With Pictures

Pin By Banas Mortgage On Banas Mortgage Loan Lenders Mortgage Approval Refinance Loans

How To Charge Your Customers The Correct Sales Tax Rates

New York Vehicle Sales Tax Fees Calculator

Wisconsin Sales Tax Calculator Reverse Sales Dremployee

How To Calculate New York Sales Tax 14 Steps With Pictures

How To Calculate New York Sales Tax 14 Steps With Pictures